SDL Payment and Declaration

SDL Payment

-

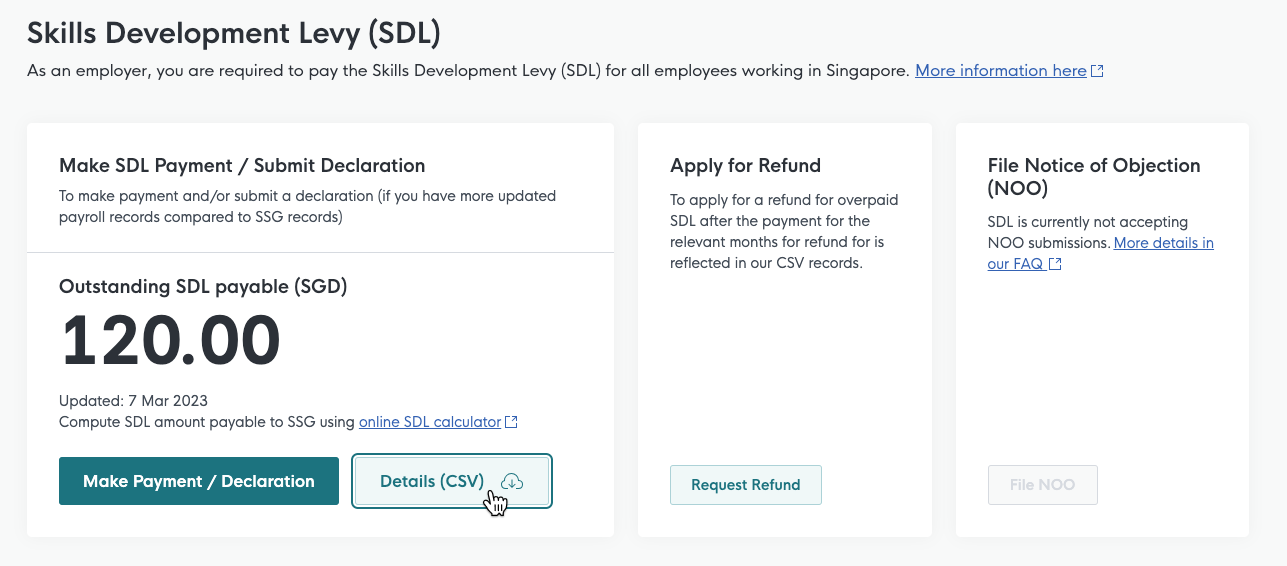

You can log in to GoBusiness Dashboard as a Business User and view the outstanding SDL amount via the SDL page.

-

To view the breakdown, click on the Download Details button in the outstanding SDL payable widget on the SDL page.

-

Employers can download the monthly breakdown of the SDL payable, SDL paid and estimated outstanding SDL payable from the SDL page via the Download Details button. This will give an overview of how the outstanding SDL payable amount was calculated.

Please review your organisation’s payroll records to determine the SDL payable for your local and foreign employees and the amount of SDL you have previously paid for the period.

You may verify your payroll records using the SDL rate of 0.25% of the monthly total wages for each employee*, with the minimum payable of $2 (for an employee earning less than $800 a month) and a maximum of $11.25 (for an employee earning more than $4,500 a month) and calculate the SDL payable amount using the SDL calculator.

* Please refer to the definition “employee” found in Section 2 of the Skills Development Levy Act 1979.

If you do not agree with any of the SDL payable in SSG’s records, you will be able to correct the amount by filling and submitting the “Declaration Form” template via SDL Payment & Declaration form when you receive an SDL Letter for the period. If you agree with all the SDL payable in SSG’s records, you may proceed to make payment using the QR code in the letter or via GoBusiness. Please note that you would not be able to submit a Declaration if you have made full payment of the outstanding SDL payable in the SDL Letter.

-

Employers with local employees are encouraged to make their monthly SDL payments together with their CPF contribution through CPF EZPay.

Employers should only use GoBusiness to make ad-hoc SDL payments or monthly SDL payments when they do not need to make monthly CPF contributions. Please refer to the General SDL FAQ for more details and requirements.

1.) Log in to GoBusiness Dashboard as a Business User, and go to Levy > Skills Development Levy (SDL).

2.) Click the Make Payment / Declaration button to get to the SDL Payment & Declaration form.

3.) Review the Applicant and Company Detail in the General Information page and update contact information, if necessary. Click Next to go to the next page.

4.) In Application Details, select the full month(s) you are making outstanding payment for. For example, if you are making payment for July and August 2022, select 01/07/2022 for Start Date, and 31/08/2022 for End Date.

Click on the Retrieve SDL Records button after selecting the month(s) range.

5.) Subsequent sections will be populated with the relevant periods and SDL records, where available. For the Relevant Period with SSG Records section, you will need to confirm the SDL payable and make a declaration if your records differ. For the Relevant Period Without SSG Records section, you will need to provide your computation before making payment as SSG will not have your records for the last 2 to 3 months.

6.) If your internal records differ from SSG’s SDL records, select “I would like to submit a declaration for relevant period with SSG records” in the declaration section. Thereafter, indicate your own records in the available SDL fields and attach the “Declaration Form” as a supporting document. If your internal records have no discrepancies with SSG’s SDL records, select “I agree with SSG’s records”.

7.) Proceed to make payment either via online payment (stripe/ credit card) through GoBusiness; or offline payment (bank transfer or PayNow) where payment instructions will be communicated separately over email from SSG.

8.) Track your transaction status on SDL Page, under SDL notifications

-

You can pay via one of the following methods:

(A) Online Payment - Credit Card

GoBusiness Dashboard currently accepts VISA and MasterCard. We are working to add more payment methods in the future.(B) Offline Payment - Bank Transfer

Remarks/Reference: [GoBusiness SubmissionID]

You may reference the payment instructions sent by SSG after submission of payment and declaration form.(C) Offline Payment - PayNow

Bill Reference Number: [GoBusiness SubmissionID]

You may reference the payment instructions sent by SSG after submission of payment and declaration form. -

Please send SSG the proof of payment, such as payment reference number or a screenshot of the payment and the correct reference number, through our feedback portal.

Declaration

-

The SDL Declaration Form serves as a declaration of the SDL payable that you have verified against your own payroll records and that you have made payment for it.

-

You will need to submit the SDL Declaration Form when your calculated SDL payable differs from the amount stated in our record after receiving a SDL Letter from SSG.

-

If you do not agree with our calculation, you will be able to correct the amount by filling and submitting the Declaration Form template via our SDL Payment & Declaration form:

1.) Log in to GoBusiness Dashboard as a Business User, and go to Levy > Skills Development Levy (SDL)

2.) Click on the Make Payment / Declaration button to get to the SDL Payment & Declaration form.

3.) Review the Applicant and Company Detail in the General Information page and update contact information, if necessary. Click Next to go to the next page.

4.) In Application Details, select the full month(s) as indicated in the SDL Letter. For example, if you are making payment/declaration for January to December 2024, select 01/01/2024 for Start Date, and 31/12/2024 for End Date.

Click on the Retrieve SDL Records button after selecting the full month(s) range.

5.) In the Provision of Employer Records section, select the from the list of values in the dropdown:

“I would like to submit a declaration for Relevant Period with SSG records”

“I agree with SSG’s records”6.) If you have selected to submit a declaration, you are required to fill in your own monthly computation in the Declaration Form template (https://go.gov.sg/sdl-declaration-form) as a supporting document for the relevant period selected and upload the template. You are also required to fill in your aggregated Outstanding SDL Payable for the full relevant period. This should match what is declared in your Declaration Form.

7.) Select the payment mode before clicking Review Form to proceed to the Declaration Review page.

8.) Once you have verified the details shown in the Review page, you may proceed to submit with and without payment, depending on whether there is any outstanding SDL payable.

-

You will need to submit declaration of Non-Liability of SDL for each affected employee. Please submit your request through SSG’s Service Portal.

Please retain all supporting documents as per your declaration as SSG may request for them subsequently.

-

You will only need to submit a Declaration if you disagree with the SDL payable amount for any of the months in SkillsFuture Singapore’s (SSG) records.

-

The Declaration Form template is an Excel form. Before you start filling the Declaration Form, you may view the monthly breakdown of SDL payable in SSG’s records by clicking on the Download Details button in the outstanding SDL payable widget on the SDL Dashboard. Thereafter, you may verify the monthly SDL payable for the relevant months for all your employees, including local and foreign employees in Singapore in your organisation’s records. You will also need to seek your organisation’s authorised representative’s approval to verify the information before filling the Declaration Form.

The following are the steps required to ensure a complete and accurate submission:

Step 1: Please complete the Declaration template using Microsoft Excel. The Declaration template is mandatory for the submission. Please do not make any changes to the template by adding additional sheets, removing any sheets, inserting any rows/columns, removing any rows/columns, changing the months etc.

Step 2: Please fill up the UEN, name of organisation and case ref no. For the case ref no, you may use the case reference no indicated in the SDL letter.

Step 3: Please complete all the months in the Declaration template for the SDL payable. If your records differ from SSG’s records for one or more months, please fill up your records for those months. For the remaining months where your records are the same as SSG’s records, please fill up either your records or SSG’s records for these months.

Step 4: If you disagree with the SDL paid in SSG’s records for any of the months, please contact SkillsFuture Singapore (SSG) through their service portal with the relevant payment screenshot.

-

No, please do not complete the SDL Declaration Form. Instead, please contact SkillsFuture Singapore (SSG) through their service portal with the relevant payment screenshot.

-

If SSG needs any clarification regarding the information you have provided in your Declaration, SSG will contact you. Please retain all supporting documents.

Under the SDL Act and Regulations, every employer liable to pay SDL shall prepare and keep the following: Employee’s full name, gender, age, address, identity card number, nature of employment, rate and amount of wages, date of commencement and cessation of employment, and such other records for SSG to ascertain the levy payable by such employer.

SSG may also request for records such as the CPFB’s Record of Payment (Form 90 / 90A) and/or relevant payment screenshot as evidence of SDL payment.

-

You will be notified of the outcome in one month’s time, provided that all required documents are in order and complete. However, processing time may be longer if additional verification is required or if there are any discrepancies in the submission.

If you do not hear from SkillsFuture Singapore (SSG) by then, please contact SSG through their service portal to check on the status.

-

Declaration must be submitted by the due date indicated in the SDL Letter.

For any late Declaration submissions, please contact SkillsFuture Singapore (SSG) through their service portal to indicate reason for not being able to submit on time. SSG will assess on a case-by-case basis.

-

Please contact SkillsFuture Singapore (SSG) through their service portal for assistance.

-

This is for SkillsFuture Singapore (SSG) to verify that you have declared and paid SDL for all your local and foreign employees.

-

Please continue to make SDL payment based on your records. If you wish to dispute on any of the SDL payable for the current year, you may do so when you receive the Notice of Assessment/SDL Letter from SSG for the stated period.