Every business owner's guide to navigating Budget 2023 schemes

Deputy Prime Minister and Finance Minister of Singapore Lawrence Wong delivered the Singapore Budget 2023 speech on 14 February. This year’s budget is focused on cushioning the impact of rising costs, and the GST increase, as well as strengthening Singapore’s economic competitiveness in the global arena.

Exiting the pandemic era last year, Singapore’s labour market showed strong growth, as total employment grew by more than 200,000 in 2022, surpassing its pre-pandemic level by three per cent. However, global inflation due to an uncertain global economic environment and geopolitical challenges bode a challenging economy moving forward.

To help Singapore businesses through this period of uncertainty, the Singapore Budget 2023 has included a series of new grants, schemes and tax deductions for employers and employees alike. Businesses can hence capitalise on the available government support to upskill workers and offset rising manpower and business costs.

Here’s our guide to navigating the Singapore Budget 2023 schemes that will help to support your business.

Uplifting your employees

Employees are at the forefront of Budget 2023, as building a healthy workplace and enhancing support for workers becomes a major focus in this year’s budget plans. As Singapore takes further steps to embark on its progressive wage journey, the budget has made room to lighten the load for employers.

To start off, the Progressive Wage Credit Scheme (PWCS) provides transitional support to employers for Progressive Wage moves, by co-funding the wage increases for lower-wage workers between 2022 to 2026.

As an employer, you will be eligible to receive PWCS co-funding support as long as the gross monthly wage increase given to a resident lower-wage employee is at least $100 for each qualifying year. The PWCS co-funds wage increases up to $2,500 under a First Tier of support, and wages above $2,500 and up to $3,000 under a Second Tier of support. Eligible wage increases are co-funded for two years – for example, a 2022 wage increase will be supported in qualifying year 2022, and also in 2023, if sustained.

There is no need for you to apply for the PWCS. Employers who have given eligible wage increases in a qualifying year can expect to receive their PWCS payouts from the Inland Revenue Authority of Singapore (IRAS) by the first quarter of the following year.

Apart from co-funding worker salaries, the Singapore government is also making strides to improve employability. This year’s budget has extended the Senior Employment Credit (SEC) and Part-time Re-employment Grant (PTRG) until 2025 to support employers in hiring and retaining senior workers.

From 2023 to 2025, if you hire Singaporean workers aged 60 and above earning up to $4000 a month, you will automatically be eligible to receive wage offsets under the SEC. No application is required and you will be notified by IRAS on the amount that’s payable to you.

In addition, if your company offers part-time re-employment, other flexible work arrangements and structured career planning to senior workers, your business may be eligible for the enhanced PTRG as well. You can apply for the PTRG through the Singapore National Employers Federation.Under the extension of both schemes, a company that employs 10 senior workers earning $3000 a month will be eligible to receive up to $104,200 for the entire eligibility period.

If you are hiring persons with disabilities (PwDs) or ex-offenders, you may be interested in the enhanced Enabling Employment Credit (EEC) for hiring PwDs, and the Uplifting Employment Credit (UEC) for hiring ex-offenders introduced in this year’s Budget. The updated EEC and the UEC are available from April 2023 to December 2025.

The EEC provides a permanent wage offset of up to 20 per cent of monthly income, capped at $400 per month per employee, for employers of Singapore Citizen and Permanent Resident PwDs earning below $4,000 per month. It also provides an additional time-limited wage offset of up to 20 per cent of monthly income, capped at $400 per employee, for the first nine months, for employers of those who have not been working for the past six months prior to hire. Payouts will be made automatically to employers. Employers who are keen to hire PwDs or provide better support to their PwD employees can get in touch with SG Enable.

The UEC provides a time-limited wage offset of up to 20 per cent of monthly income, capped at $600 per month per employee, for the first nine months, for employers of Singapore Citizen and Permanent Resident ex-offenders earning below $4,000 per month and released within three years prior to their date of employment. Payouts will be made automatically to employers of ex-offenders placed by Yellow Ribbon Singapore, Industrial and Services Cooperative Society, or halfway houses in contract with the Singapore Prison Service. If you have already employed ex-offenders, you can also apply for the UEC from 1 April 2023. The first payout for eligible hires will be made from May 2024.

Alleviating cost pressures

Apart from helping businesses with hiring costs, this year’s budget includes additional support to help businesses weather the immediate challenges of tighter financial conditions and higher energy prices.

Through the Enterprise Financing Scheme (EFS), the Government shares in the risk of leone defaults with participating financial institutions. To help enterprises meet increased cashflow needs amid inflationary pressures, the enhanced parameters for the EFS have been extended to 31 March 2024. This includes the 70 per cent Government risk share for Trade Loans, the enhanced maximum quantum for Trade and Working Capital Loans, and support for domestic projects via project loans. For more details, you can refer to the Enterprise Singapore website.

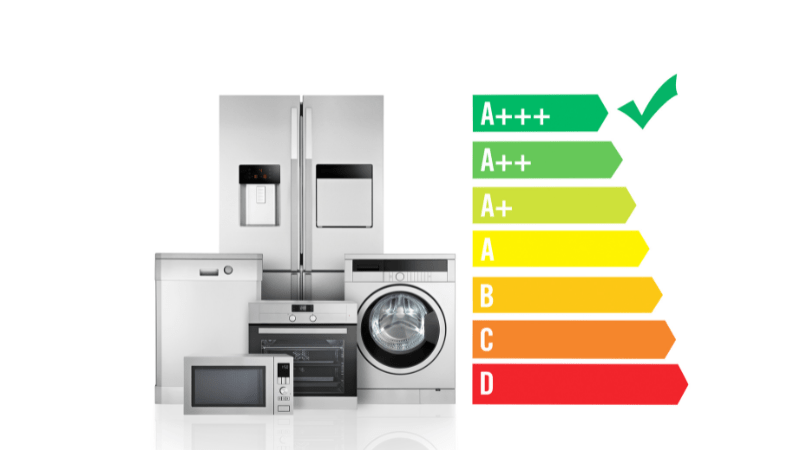

Are you looking to acquire energy-efficient equipment for your business? If you are, then your business could be eligible for the Energy Efficiency Grant, which has been extended to 31 March 2024. SMEs in the Food Manufacturing, Food Services and Retail sectors can receive up to 70 per cent support to adopt pre-approved energy-efficient equipment in the following categories: LED lighting, air-conditioners, refrigerators, cooking hobs, water heaters, and clothes dryers.

You can apply for the Energy Efficiency Grant through the Business Grants Portal.

Support to sustain innovation

A volatile global economy means deterred growth for some, but it could also mean opportunities for others who have a good grasp on the changing market. As the business climate fluctuates, you will need to keep improving and build up the financial position of your business to weather the challenges ahead.

To help businesses continue to grow and improve their products through research and development, the enhanced Enterprise Innovation Scheme (EIS) includes greater tax deductions for R&D, innovation and capability development activities.

Currently, companies are allowed tax deductions of up to 250 per cent of qualifying expenditure for R&D and innovation activities. Under Budget 2023, tax deductions will be raised to 400 per cent for five innovation activities, namely, R&D conducted in Singapore, Registration of intellectual property (IP) including patents, trademarks and designs, Acquisition and licensing of IP rights, innovation carried out with polytechnics and institutes of Technical Education (ITEs) as well as Training via courses approved by SkillsFuture Singapore and aligned to the Skills Framework.

Open to all businesses with various eligibility criteria and qualifying costs for the different deductions, the EIS caps qualifying expenditure at S$400,000 for each innovation activity, except for innovation carried out with polytechnics and ITEs, which will be capped at S$50,000. Tax deduction claims will be done on an annual basis, together with the income tax filing cycle.

If your business is in need of cashflow, you can also opt to partially convert to a non-taxable cash payout at a cash conversion ratio of 20 per cent or up to $100,000 of qualifying expenditure, in lieu of tax deductions or allowances. The payout can help to defray the costs of the innovation activities, even if your business is small enough to pay little or no taxes.

More information on EIS is available on GoBusiness.

Encouraging corporate volunteerism

Last but not least, you can enjoy tax deductions while giving back to society. Under the Corporate Volunteer Scheme (CVS), businesses can receive up to 250 per cent tax deductions on wages and qualifying expenditure when their staff volunteer or provide services to Institutions of a Public Character (IPCs), including through secondments.

Under this year’s Budget, the CVS (previously known as the Business and IPC Partnership Scheme) has been extended by three years to 31 December 2026. The qualifying expenditure has also been doubled to S$100,000 for each year of assessment. The qualifying expenditure cap per business remains the same at $250,000 per year of assessment. All businesses carrying out a trade or business in Singapore are eligible for CVS when they send their employees to volunteer and provide services at IPCs. The scope of qualifying volunteering activities will also be expanded to include activities which are conducted virtually (e.g. tuition support for youths/children) or outside of the IPCs’ premises (e.g. refurbishment of rental flats).

Tax deduction claims will be done on an annual basis, aligning with the income tax filing cycle.

While we recover from the pandemic, Budget 2023 is committed to many support schemes to tide businesses like yours through the economic uncertainties and challenges. And as we face an unstable economic climate ahead, creating a conducive business environment and maximising opportunities will be the key to empower businesses in Singapore.

Learn more about Budget 2023 schemes, and visit the GoBusiness Budget page for the latest budget schemes available to support local businesses.

This article is accurate as at 19 Apr 2023