Tips to hiring your first full-time employee

When starting your own business, you can usually get by on your own during the initial stages. But sooner or later, your bandwidth will limit the growth of your business, and hiring a full-time employee will help you keep your business from plateauing.

As a business owner, one of the most important steps in your business journey is hiring your first full-time employee. But hiring can be daunting especially if you are doing it for the first time. From logistical headaches and legal requirements to finding the right profile for the role, hiring employees can be cumbersome, if you don’t have all the steps planned beforehand.

From job listing to staff skills training, here are six simple steps to follow when it comes to recruiting your first full-time employee:

1. File for the necessary applications

The first step to hiring an employee is to apply for the necessary documents. You may encounter quite a bit of paperwork throughout the recruitment process, so embarking on the paperwork process early is always a good idea.

As a rule of thumb for hiring practices, the recruitment process should abide by all the relevant Tripartite Guidelines on Fair Employment Practices.

Hiring locals

If you are hiring a Singaporean or Singapore PR employee, you will need to apply for a Central Provident Fund Submission Number (CSN) to make CPF contributions as an employer.

If your employees are earning more than S$500 per month, as an employer, you are permitted to deduct the employee’s share of the mandatory CPF contributions from their wages to be deposited into their CPF account. Every month, you will be expected to contribute two portions of money to your employee’s CPF account, which includes the employee’s contribution (20 per cent of their wage) and the employer’s contribution, which consists of 17 per cent of the employee’s wage.

The due date for CPF contributions is on the last day of the calendar month. You can easily submit your CPF contributions via CPF EXPay and CPF EZPay Mobile.

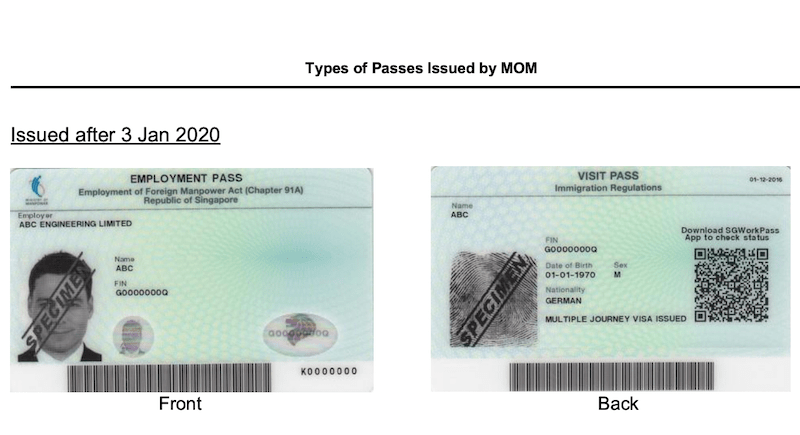

Hiring foreigners

There are additional steps if you are hiring a foreign employee in Singapore. First of all, employers will need to set up a Work Pass Account to register for online accounts and declare your business activity.

For applicants in managerial, executive or specialised jobs earning more than S$5,000 a month, employers will need to apply for an Employment Pass Online (EPOL) for the candidate. The candidate would require the necessary academic qualifications and an already-extended employee offer. Applications typically take around three weeks to process and employers can appeal if your application is rejected.

Mid-level skilled workers earning at least S$3,000 a month would require employers to apply for an S Pass. Employers can use the S Pass Self Assessment Tool to check that their candidate is eligible for S Pass application.

To apply for the S Pass, employers are required to buy the primary care plan for workers who stay in dormitories or work in CMP sectors Next, they would have log in to the myMOM Portal to fill in the application, upload the required documents, declare that they have bought the PCP, and select the option to be considered for both the Employment Pass and the S Pass. Application for the S Pass takes about three weeks to process.

Lastly, semi-skilled workers in the construction, manufacturing, marine, process of services sector will require a work permit. Employers will then have to apply for the appropriate work pass for foreign employees via Work Permit Online (WPOL).

To regulate the demand for foreign workers in Singapore, the Singapore Government also collects a Foreign Worker Levy (FWL) for all low-skilled and unskilled foreign employees. Employers will have to take into consideration the FWL into their costs as well.

There are stiff penalties for foreigners who work without the relevant work passes, so do make sure that all passes and permits are approved by Ministry of Manpower (MOM) before you hire any foreign employees.

2. Put up a job listing and interview candidates

Once you have applied for all the administrative paperwork, you’re all set to meet your new potential employees! The next step would be to craft a clear job description for the position that needs to be filled. You can reference the SkillsFuture Framework which includes individual guidelines on how to write a job description for each of the relevant sectors.

Next, you can advertise your listing on job search portals such as MyCareersFuture, or LinkedIn, to reach out to applicants. Do note that if you are looking to hire foreigners on an Employment Pass, you must first advertise the job on MyCareersFuture for at least 28 consecutive days.

Picking the right person for any job is never an easy task. Focus on finding the right member for your team. Apart from reviewing resumes or job application forms for qualifications, skills, knowledge, and the experience required for the job, you should take note of character references and testimonials from previous employers as well, to make sure that your new employee possesses a good attitude and the soft skills needed to be a trustworthy team-member.

Once you’ve shortlisted your job applicants, you can schedule interviews with the candidates, to ensure that you are hiring a profile who is a good cultural fit for your business.

3. Negotiate the employment terms and learn your laws

The interview stage went smoothly and you’ve found your suitable candidate! The next step would be to negotiate the Key Employment Terms (KETs) and send the candidate an offer letter.

The KETs should include your employee’s job title, responsibilities, and duties, their working arrangements, including working hours, days, and rest days as well as their basic salary, salary period, and other salary-related components such as bonuses or allowances. It should also detail the types of leave and medical benefits available, as well as their probation and notice period.

For reference, a sample KETs form is available on the MOM website. You can also use the MOM’s KETs verification tool to check if work arrangements, salary, and other components meet the Employment Act requirements.

Once your offer has been accepted by the job applicant, you will need to sign an employment agreement, also known as a contract of service, which sets out the terms governing the relationship between an employer and an employee. All KETs must be included in the employee agreement, and your employee is also required to sign and return the employment agreement to you.

Should you need further information about employee agreements, you can refer to the MOM website’s details on contracts of service.

4. Purchase work injury compensation insurance

Work injury compensation insurance is essential to protect your business, and to provide peace of mind to your employees. In the event of any workplace accidents or mishaps, a comprehensive work injury compensation package will provide sufficient cover for your employee’s medical leave wages, medical expenses, and a lump-sum compensation for permanent incapacity or death.

For both local and foreign employees, employers must purchase work injury compensation insurance to cover all employees who are doing manual work, as well as employees who are earning $2600 or less each month. For other employees, employers have the flexibility to decide whether to purchase insurance for them, but it is highly recommended to do so.

You can find this list of work injury compensation designated insurers on the MOM website.

5. Design a training process

Now that you are done with the nitty-gritty details, you’ll be able to welcome your new team member on board! But before you can jump right into delegating work, it is important to have a clear orientation for new employees and training and development to help your new team member adapt well to the job.

Some positions will require more training than others if you would like to help your employee progress their careers in the long run. But have no fear, because there are plenty of options for employers who want to help their employees upskill.

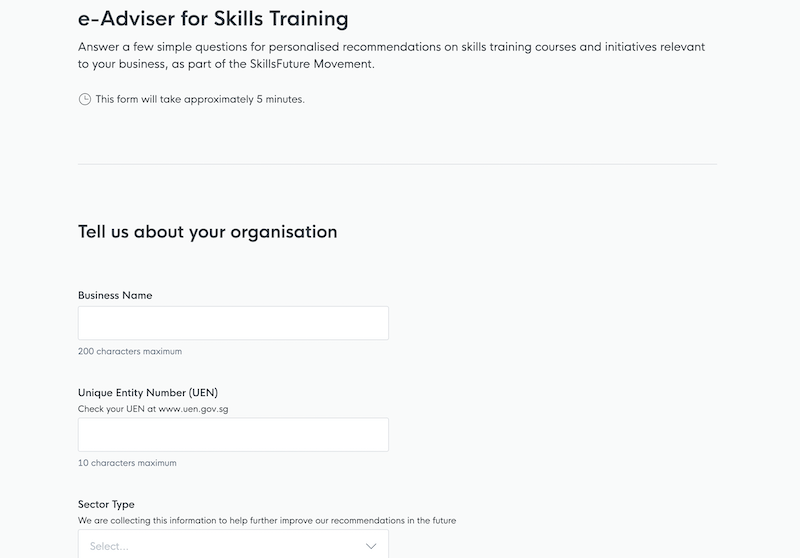

For starters, check out SkillsFuture for Business to help you navigate the process. If you are having trouble determining the right training courses to send your employee for, just fill in a 5-minute questionnaire on the e-Adviser for Skills Training and you will be redirected to the relevant courses tailored to your business’s needs. The e-Adviser also suggests relevant grants and subsidies to help you defray costs while upskilling your employees.

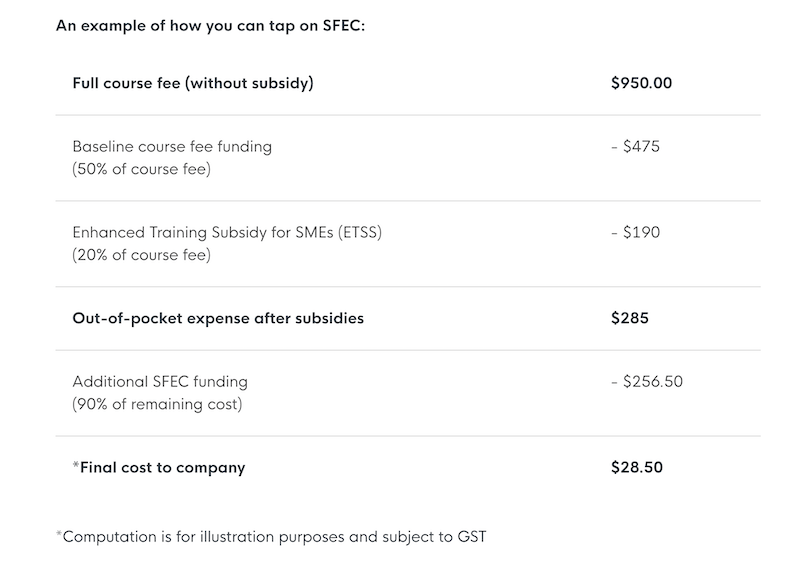

If your business is just taking off and training costs might be an issue, there are many grants and training support schemes available. Under the Enhanced Training Supports for SMEs (ETSS), course fee funding can be subsidised up to 90 per cent. In most cases, course fee subsidies are automatically computed and companies will only need to pay the net course fee and GST to the training provider.

The SkillsFuture Enterprise Credits (SFEC) also provides S$10,000 credit to further encourage businesses to embark on workforce transformation and training. Under the SFEC, an additional 90 per cent funding support is provided for out-of-pocket expenses when eligible enterprises send their employees for SSG-funded training courses.

No application is required for the SFEC. Enterprises that are eligible for SFEC will be notified by Enterprise Singapore in writing, and companies can find out their SFEC balance by logging in to the SkillsFuture Enterprise Credit system.

Alternatively, employers can train your employees via lessons through the SkillsFuture Series, a curation of short, industry-relevant training programmes that focus on emerging skills in the Digital, Green, Care, and Industry 4.0 economic growth pillars. The programme comprises 3 proficiency levels, namely Basic, Intermediate, and Advanced, and it targets Singaporeans who are keen to improve their knowledge of these emerging sectors to stay relevant for the future.

For employers who would prefer for their workers to have more on-the-job learning experiences, you can approach the National Centre of Excellence for Workplace Learning (NACE), which offers training and consultancy to help companies set up workplace learning systems. Their Workplace Learning: READY (WPL:READY) initiative aims to help SMEs develop effective on-the-job learning processes.

NACE is also launching a new level certification to help workers get fast-tracked skills certifications through the Workplace Skills Recognition (WPSR) programme. The WPL:READY mark certification helps certified companies to work with SSG’s appointed training partners to formally recognise the skills their workers trained on-the-job, without the need for further external training.

Interested employers can find out more about the certification process on the NACE website, and more information on the Workplace Skills Recognition Programme can be found on GoBusiness.

For an extensive list of courses, visit the SkillsFuture Singapore (SSG) website, to choose your desired training area from a wide range of SSG-funded courses such as Workforce Skills Qualification courses or short courses in emerging areas and Critical Core Skills (soft skills).

6. Keep a tidy payroll

Last but not least, employers should keep an organised payroll system to keep track of the business finances, and ensure that employees are paid on time.

According to the Employment Act, payslips should be issued within three working days of salary payment, and employers should keep clear employment records which consist of employee records and salary records. This helps employees better understand how their salary is calculated and helps minimise payment or salary disputes in the workplace.

If you have sent your employees for SSG-funded training, you are eligible to apply for the Absentee Payroll (AP) funding, a grant which helps to defray some manpower costs incurred.

You will be asked to declare your employees’ hourly salary information (before CPF deduction) on the Enterprise Portal for Jobs and Skills for AP claim. AP funding is provided at a flat rate of S$4.50 per hour, capped at $100,000 for each organisation per calendar year.

Employers can access all their claim services via the AP funding page, and AP funding will be reimbursed to companies via PayNow within two and a half weeks after submission of the AP declaration.

And with that, you’re all set to welcome a new member to your team. Congratulations on completing an important milestone in your business journey!

Although hiring your first employee may be overwhelming at first, it will all be worth it when you find the right person for the job. With the proper planning and preparation by following the steps above, the hiring process can be made fuss-free, and you can create an enriching and productive work environment for both you and your employee.

This article is accurate as at 12 May 2023